Alright – so today we’ve got the honor of introducing you to Jacqueline Jenkins Johnson. We think you’ll enjoy our conversation, we’ve shared it below.

Jacqueline, we’re thrilled to have you on our platform and we think there is so much folks can learn from you and your story. Something that matters deeply to us is living a life and leading a career filled with purpose and so let’s start by chatting about how you found your purpose.

My mother taught me the importance of serving others at a young age. My first volunteer position was with the Red Cross as a candy-striper. After high school, my father sent me to Real Estate School. He thought I could thrive in the industry. I identified my purpose after helping women in transition with their finances. Everyone deserves the opportunity to understand their finances, how the economic system works, and the long-term benefits of homeownership.

Thanks for sharing that. So, before we get any further into our conversation, can you tell our readers a bit about yourself and what you’re working on?

After serving the Denver community for over 20 years in real estate, my focus now is to change a million minds regarding their finances. Because of my faith, I have owned property since the age of 26 and never experienced renting. Three out of four of my children (ages 25 – 29) own homes. After my fourth child finishes her graduate degree, she will also become a homeowner. A mindset change must occur first before developing a good financial regiment.

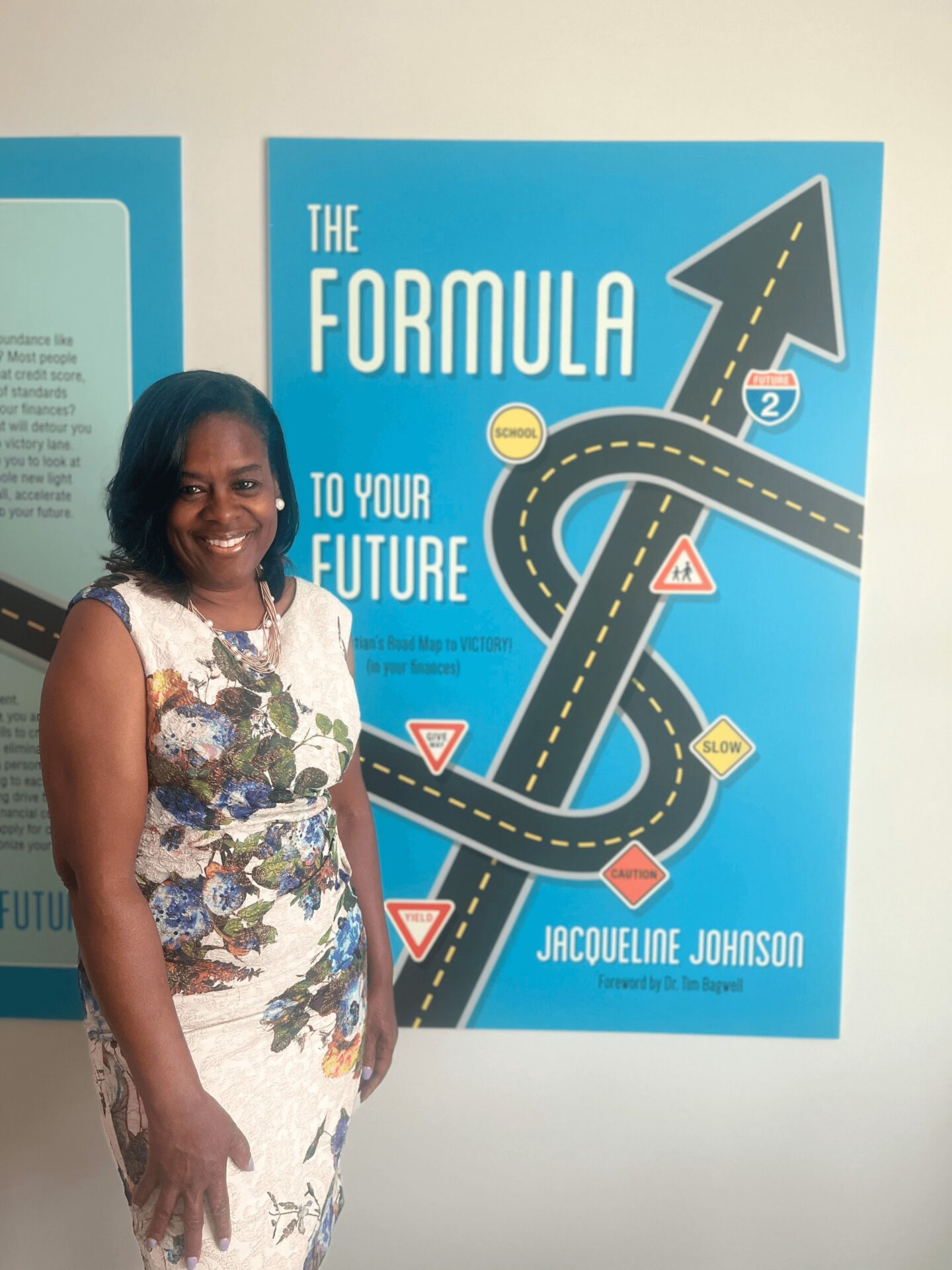

My goal is to educate Black individuals to achieve financial proficiency, while deconstructing mythical behaviors that plague our communities specifically regarding real estate and personal finances. Right now, I offer free classes to groups of 25 or more, and affordable, one-on-one sessions. Contact me directly or through my website. You can purchase my book, “The Formula to Your Future” directly from me or also available on Amazon.

There is so much advice out there about all the different skills and qualities folks need to develop in order to succeed in today’s highly competitive environment and often it can feel overwhelming. So, if we had to break it down to just the three that matter most, which three skills or qualities would you focus on?

The art of consultative selling was introduced to me in 1992, by a previous employer. This method ensures that you will close the sale if you effectively listen and fact-find, thus building trust with the consumer. Across all industries, I believe this practice can demonstrate genuine care for the consumer and will produce continuous customer satisfaction results.

It is imperative to know and understand why you do what you do, including how affiliates play a part in your business model. When you become a master of your craft and build rapport with clientele, you are destined to stay relevant in any market.

Three qualities:

• Effectively listen to stakeholders, affiliates, employees, and clientele.

• Ask questions when you need clarity.

• Stay knowledgeable (strive to continue to evolve) in your industry.

Tell us what your ideal client would be like?

Anyone who struggles financially and wants to stop the cycle of mismanaging their finances.

Anyone who wants third-party advice regarding real estate.

Any self-employed individual who wants to learn how to weather the storm in any market.

Contact Info:

- Website: https://www.jacquelinejohnsonfinances.com

- Facebook: https://www.facebook.com/whyNOTown/

- Linkedin: https://www.linkedin.com/in/jacquelinejohnson419/

- Other: My website will soon be updated. Hopefully, by the time this article is published.

Image Credits

n/a

so if you or someone you know deserves recognition please let us know here.