We recently connected with Jacqueline Crider and have shared our conversation below.

Jacqueline, thanks so much for taking the time to share your insights and lessons with us today. We’re particularly interested in hearing about how you became such a resilient person. Where do you get your resilience from?

My resilience comes from the challenges I’ve faced and overcome throughout my life. During my younger years, I balanced working full-time, attending night law school, and enduring a two-and-a-half-hour daily commute. It was grueling, but it taught me that I could accomplish anything I set my mind to, no matter how difficult or overwhelming it seemed. That realization became a cornerstone of my resilience—it showed me that perseverance and determination could carry me through even the toughest situations.

On a more personal level, I also survived a marriage that was deeply unhealthy. I endured emotional, financial, and eventually physical abuse, which was devastating at the time. But coming out of that experience taught me invaluable lessons about my own strength and worth. It wasn’t easy to rebuild, but in doing so, I realized how much power I have to create the life I want. Those moments of clarity, where I learned to trust myself and fight for a better future, shaped my ability to adapt and thrive.

Today, I approach challenges with a sense of calm and confidence, knowing I’ve faced worse and come out stronger. I’ve learned that resilience isn’t about being unshakable—it’s about learning, growing, and finding your way forward, even when the path seems unclear. Those experiences have not only fortified my resolve but also given me a deep appreciation for the strength we all have within us, even in the most difficult circumstances.

Thanks, so before we move on maybe you can share a bit more about yourself?

I’m Jax Crider, and I wear a couple of hats in the financial world—I’m the founder of PBJ Mortgage and the creator of Financial Mastery Simplified. Through PBJ Mortgage, I help people navigate one of life’s biggest financial decisions: homeownership. My goal is to make the process as simple and straightforward as making a peanut butter and jelly sandwich, while empowering clients with the education and tools they need to feel confident in their decisions.

Financial Mastery Simplified takes that mission a step further. It’s all about helping people achieve financial success on their terms through courses, coaching, and free tools. What I find most exciting about this work is the transformation it inspires. So many of my clients have struggled to fit into the traditional mold of financial advice, feeling stuck or overwhelmed, but through my programs, they discover that there’s no one-size-fits-all solution. Instead, they learn how to trust themselves, rewrite their financial mindset, and create a plan that resonates with their unique values and goals.

This year is especially exciting as I launch the “Financial Instinct Framework”, a program designed to help individuals reset their financial mindset and build a money plan that works for them. It’s a holistic approach that integrates practical tools with mindset shifts, NLP principles, and even a fun Financial Spirit Animal Quiz to make the journey engaging and personal. The program begins in January, and I couldn’t be more thrilled to see how it will empower participants to take control of their financial futures.

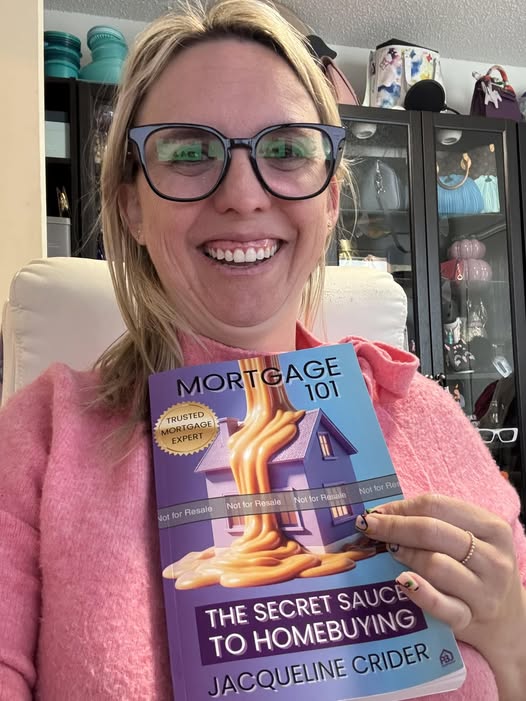

What drives everything I do is a passion for education, empowerment, and making finances approachable. Whether through PBJ Mortgage, my Mortgage 101: The Secret Sauce to Homebuying book, or Financial Mastery Simplified, my mission is to help people find confidence and clarity in their financial lives—because I truly believe we’re all more than capable of achieving success when we’re equipped with the right tools and support.

If you had to pick three qualities that are most important to develop, which three would you say matter most?

Looking back, three qualities that have been most impactful in my journey are perseverance, adaptability, and a commitment to education. Perseverance has been essential because life has thrown its fair share of challenges my way—whether it was balancing work, school, and a demanding commute, overcoming the struggles of an unhealthy relationship, or even navigating my own financial challenges after taking a significant risk. The ability to push forward, even when the odds felt stacked against me, has been the foundation of my success.

Adaptability has been equally important. The financial world, like life itself, is constantly changing. Learning to pivot—whether it’s navigating a slowing mortgage market by expanding my brand with courses, a podcast, and a book, or finding ways to help others see that there’s no one “right” financial path—has been key to staying relevant and impactful.

Finally, education has been my compass. I’ve always been curious and driven to learn, whether earning degrees, exploring nontraditional methods of success, or researching how to make financial concepts accessible to others. That thirst for knowledge has shaped not just what I do but how I connect with and empower others.

For those early in their journey, my advice is to start by cultivating perseverance. Take small steps toward your goals, even when the bigger picture feels overwhelming. Build habits that reinforce your ability to show up consistently—it’s those small wins that snowball into big results.

When it comes to adaptability, give yourself permission to evolve. Life and career paths are rarely linear, and that’s okay. Stay open to new opportunities and perspectives, and don’t be afraid to shift gears when something isn’t working.

Finally, prioritize education—not just formal learning, but also self-education. Read, explore, and ask questions relentlessly. The more you invest in your growth, the more tools you’ll have to navigate whatever comes your way. Most importantly, trust yourself and your journey. Success looks different for everyone, and the only “right” path is the one that feels aligned with your unique values and goals.

One of our goals is to help like-minded folks with similar goals connect and so before we go we want to ask if you are looking to partner or collab with others – and if so, what would make the ideal collaborator or partner?

Absolutely, I’m always looking to collaborate with like-minded individuals and professionals who share a passion for empowering others and making a positive impact.

For the mortgage space, I’m interested in partnering with professionals—real estate agents, financial advisors, attorneys, and others—who value expertise and education. I’m looking to collaborate with those who understand the importance of simplifying complicated processes for their clients while ensuring they have access to clear, knowledgeable guidance. If you and your clients place a premium on working with trusted experts who prioritize educated choices and delivering exceptional service, we should connect!

I’m also looking for guests for my podcast, *Financial Mastery Simplified*, who have insights into simplifying anything that touches the financial space. Whether you’re a financial expert, mindset coach, or someone with a unique perspective on making the financial journey easier and more accessible, I’d love to feature your ideas and stories on the show.

Finally, I’m eager to collaborate with individuals or organizations dedicated to uplifting women, particularly those who want to empower women to achieve financial independence but don’t necessarily focus on finance themselves. Whether your expertise lies in coaching, wellness, career development, or community building, I’d love to explore how we can work together to help women thrive in all areas of their lives.

If you’re interested in collaborating, feel free to reach out to me at [email protected] or connect with me on social media. Let’s join forces to make a meaningful difference together!

Contact Info:

- Website: https://urals.co/jax-crider

- Instagram: https://www.instagram.com/jax_crider

- Facebook: https://www.facebook.com/jax-crider

- Linkedin: https://www.linkedin.com/in/pbj-mortgage-jacqueline-crider/

- Twitter: https://x.com/pbjmortgage

- Youtube: https://www.youtube.com/@FinancialMasterySimplifi-vr2wp

- Other: https://www.tiktok.com/@pbj.team

Image Credits

Bold Social

so if you or someone you know deserves recognition please let us know here.