We recently had the chance to connect with Morgan Ehrenzeller and have shared our conversation below.

Morgan, it’s always a pleasure to learn from you and your journey. Let’s start with a bit of a warmup: What is a normal day like for you right now?

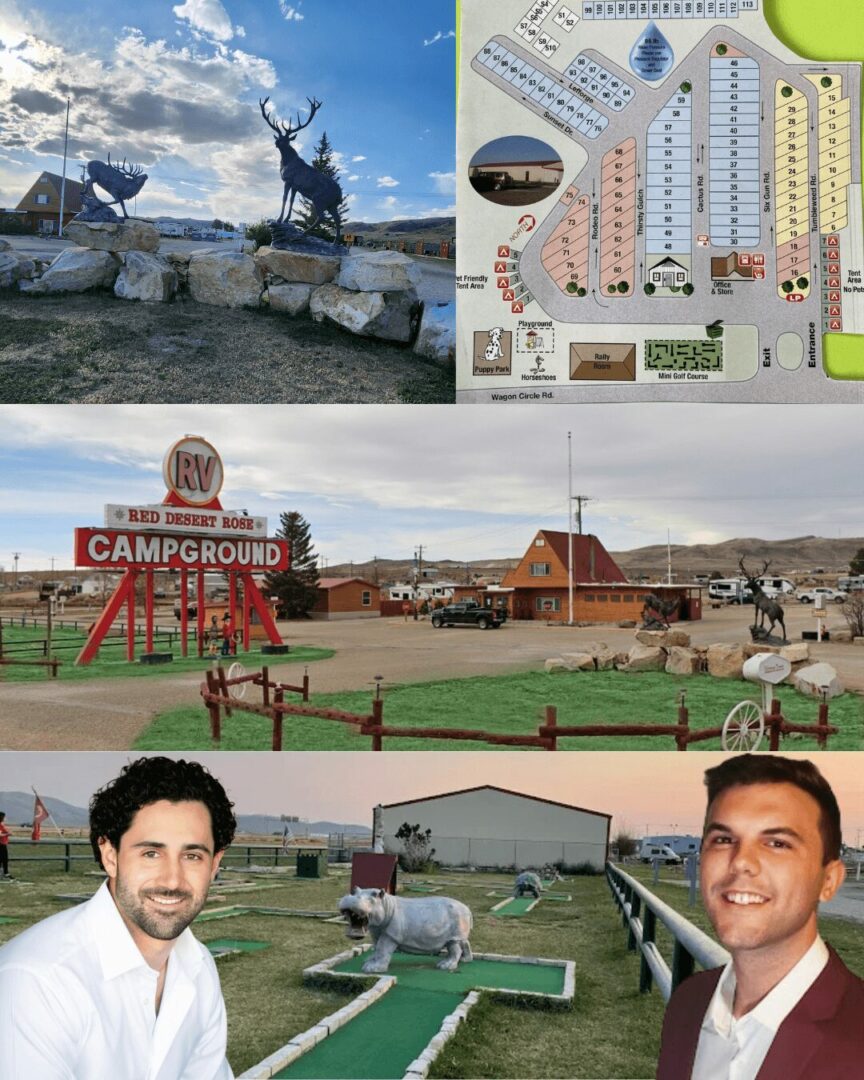

A normal day for me doesn’t really feel “normal” in the traditional sense — I’ve built my life around growth, momentum, and solving problems at scale. My mornings typically start early. Before most people get moving, I’m already reviewing occupancy reports, CapEx updates, and revenue trends across the 330+ units we own nationwide. Because my portfolio spans multiple states and asset types — multifamily, RV parks, mobile home parks, mixed-use properties — I spend the first hour making sure every property manager has what they need and that the projects under renovation are progressing on schedule.

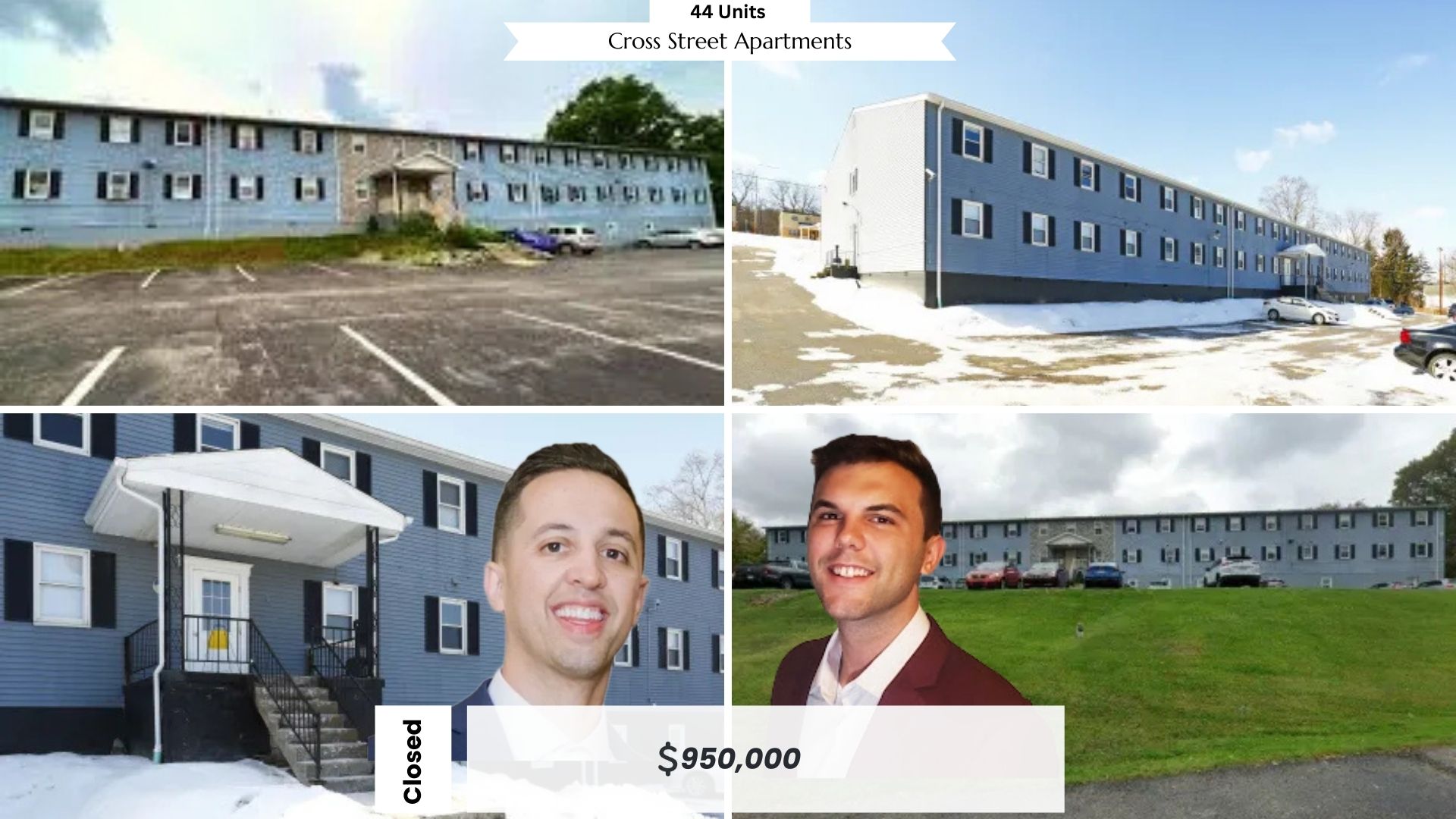

From there, my day shifts into acquisitions mode. I’m constantly underwriting new deals, negotiating creative finance structures, and working with brokers, sellers, and lenders. Most of the assets we buy are distressed, so a big part of my routine is evaluating how quickly we can stabilize them and reverse the downward trends. It’s a rhythm I enjoy — turning chaos into cash flow.

A good portion of my midday is spent with my team. Whether it’s my VAs, my executive admin, my operations staff, or the people inside my community, The Closers Table, I’m always teaching, building systems, refining SOPs, and creating content. I’ve learned that scaling isn’t about doing more — it’s about replacing yourself with processes.

In the afternoons, I’m usually either walking a property, closing on something new, or structuring a deal. Creative finance is my lane, so I’m often working through subject-to assumptions, seller finance structures, master lease options, or negotiating performance-based terms. These are the strategies that built my portfolio, and I practice them daily.

Evenings tend to be split between two things: content and relationships. I film or review reels, drop educational posts for my community, or plan upcoming modules for my courses. And I make time for the personal relationships that keep me grounded my family, and the people who matter.

My days are long, but they’re intentional. I’m building a portfolio, a brand, and a community that can help others replicate what I’ve done. Every day looks different, but the mission is always the same: scale, serve, and create opportunities — for my team, my tenants, my partners, and the investors who follow my journey.

Can you briefly introduce yourself and share what makes you or your brand unique?

My name is Morgan Ehrenzeller, and I’m a 28-year-old real estate operator who specializes in acquiring and revitalizing distressed multifamily, RV parks, and mobile home communities across the United States. I currently own and operate over 900 units nationally, and I’ve built my entire portfolio using creative finance—structures like subject-to, seller finance, master lease options, and performance-based deals that allow me to scale aggressively while keeping capital efficiency front and center.

My story started long before real estate. I grew up in a town of 700 people, started a software company at 14, and bought my first duplex at 17. My dad and grandfather were carpenters, so I’ve literally been on job sites since I could walk. Those early years taught me construction, grit, and how to solve problems with my hands—skills that now allow me to take on heavy value-add projects that most investors avoid.

Today, I run several businesses, including my investment company and The Closers Table, a community where I teach investors nationwide how to scale using creative finance. Everything I build is designed through the lens of an operator—systems, processes, acquisitions funnels, and hands-on strategies that actually work in the real world.

What makes my brand unique is that I don’t just talk about creative finance or value-add—I live it daily. I’m renovating entire apartment complexes, stabilizing RV parks, building teams, negotiating with sellers, walking units, and turning around distressed assets in real time. And I bring that transparency into my content, my community, and my coaching.

Right now, I’m focused on scaling to 5000+ units, launching additional operational companies to support our properties, and expanding The Closers Table to help even more investors close their first creative finance deals. My long-term mission is simple: take distressed communities and turn them into places people are proud to live, while helping new investors build wealth with strategies that don’t require millions of dollars to get started.

Okay, so here’s a deep one: What breaks the bonds between people—and what restores them?

In my experience—both in business and in life—bonds between people rarely break because of one big dramatic moment. They usually erode slowly through misaligned expectations, lack of communication, and unmet needs that never get voiced. Most relationships—whether between partners, family, team members, or friends—start with trust, but they weaken when one side feels unheard, unsupported, or unappreciated.

Ego plays a big role, too. When people start protecting their pride instead of the relationship, the connection usually suffers. Resentment fills the silence that honest conversations could have cleared up instantly.

What restores bonds is the opposite: responsibility, clarity, humility, and genuine effort. Relationships heal when someone takes the first step to say:

“Here’s what hurt me.”

“Here’s what I need.”

“Here’s what I could’ve done better.”

“Let’s fix this together.”

Most people don’t actually need perfection—they need transparency, respect, and follow-through. When both sides are willing to drop the armor, take accountability, and rebuild trust with actions instead of promises, bonds become stronger than they were before.

At the end of the day, relationships thrive where communication is honest, effort is consistent, and both people feel safe being fully themselves. When those elements return, the bond returns with them.

What did suffering teach you that success never could?

Suffering taught me things success never had the power to—mainly because pain forces you to pay attention in a way comfort never will.

Growing up in a small town with very little, watching my family struggle, and feeling the weight of wanting to change our circumstances taught me hunger, resilience, and responsibility long before success ever showed up. When you come from that environment, you don’t get the luxury of entitlement. You learn how to problem-solve, how to work with your hands, how to take the punches life throws at you, and keep moving anyway.

Suffering taught me empathy—real empathy. When I walk into a distressed apartment complex or an RV park where families are barely hanging on, I understand what it feels like to want better but not have the resources. That’s why restoring communities matters to me. It’s not just real estate—it’s giving people the stability I didn’t always have.

It also taught me self-belief in a way success never could. Success is loud—it brings applause, attention, and validation. But suffering is quiet. It forces you to learn how to trust yourself when no one is clapping, when no one understands the vision yet, when you’re building in silence with nothing but grit and a promise you made to yourself.

And maybe the biggest lesson: suffering taught me to keep going long after motivation fades. Success can make you soft if you’re not careful. But suffering builds a different kind of muscle—one that shows up when things fall apart, when the deal goes sideways, when the property burns down, when life hits harder than you expected. That strength only grows in struggle.

Success teaches you what you can have.

Suffering teaches you who you are.

So a lot of these questions go deep, but if you are open to it, we’ve got a few more questions that we’d love to get your take on. What are the biggest lies your industry tells itself?

One of the biggest lies in real estate is that you need millions of dollars, perfect credit, and a traditional financing path to build a meaningful portfolio. That narrative keeps people on the sidelines for years. The truth is, the industry is full of creative structures—subject-to, seller finance, master lease options—that allow you to control assets without the barriers everyone assumes are mandatory. Most investors don’t avoid creative finance because it doesn’t work—they avoid it because they don’t understand it.

Another lie is that investing is “passive.” There’s nothing passive about taking over distressed properties, turning them around, managing contractors, dealing with lenders, or stabilizing communities. Passive income exists, but only after you build real operations, real systems, and a real team. Too many people sell the dream without showing the work.

The industry also loves to pretend that buying pretty, turn-key buildings makes you an investor. It doesn’t. Operators—the people willing to take on heavy value-add, fire-damaged buildings, 8%-occupied complexes, broken infrastructure, and low-income properties—are the ones who create the most value. But because those deals aren’t glamorous, most people don’t talk about them.

And finally, one of the biggest lies: that more units equals more success. In reality, more units without leadership, processes, and culture will destroy you faster than it will enrich you. Scaling only works if your systems scale with you. Otherwise, you’re not building an empire—you’re building a time bomb.

The investors who win long-term aren’t the ones posting the nicest pictures or bragging about biggest purchase prices—they’re the ones quietly solving real problems, structuring deals creatively, and rebuilding communities from the ground up.

Okay, so let’s keep going with one more question that means a lot to us: What do you think people will most misunderstand about your legacy?

I think the biggest misunderstanding about my legacy will be assuming it was built on deals, unit count, or money. People see the closings, the acquisitions, and the heavy value-add projects, and they assume the story is about scale. But that’s only the surface.

My real legacy isn’t the number of doors I own—it’s the doors I’ve opened for other people.

A lot of people will look back and think I was just aggressive with creative finance or that I built a big portfolio quickly. But what they might overlook is that everything I’m doing is meant to show others what’s possible, especially the people who come from the same kind of background I did—small town, limited resources, and no blueprint handed to them.

They might misunderstand that my legacy was never about building real estate for myself. It was about building pathways:

Pathways for struggling communities to become safe, stable places to live.

Pathways for new investors to break into an industry traditionally gatekept by capital requirements.

Pathways for people to rewrite their story the same way I rewrote mine.

Another thing people may misunderstand is the “speed.” They see how fast I’ve grown—buying distressed properties, turning them around, scaling across multiple states—and they may think it was luck or timing. But the truth is, it was suffering, grit, and years of navigating adversity that shaped the operator I became. The speed is the result of preparation, not shortcuts.

Finally, people may assume my brand is centered around business. But my real legacy will be measured in people—my team, my community, my partners, my family. The Closers Table, the investors I’ve helped, the operators I’ve mentored… that’s the impact that will outlive me.

At the end of the day, I’m not trying to be remembered as someone who bought a lot of buildings.

I want to be remembered as someone who built a lot of people.

Contact Info:

- Website: https://www.ehrenzellercapital.com

- Instagram: MorganEhrenzeller

- Linkedin: https://www.linkedin.com/in/morgan-ehrenzeller-7353651a5/

- Twitter: MorganEhrenzeller

- Facebook: Morgan Ehrenzeller

- Youtube: Morgan Ehrenzeller

so if you or someone you know deserves recognition please let us know here.