We recently connected with Darla Bishop and have shared our conversation below.

Darla , so good to have you with us today. We’ve always been impressed with folks who have a very clear sense of purpose and so maybe we can jump right in and talk about how you found your purpose?

For a long time, I believed I had to choose between taking care of the people I loved and building the life I wanted. That belief came from growing up in Detroit, where money was always tight and family came first—no matter the cost. When a family situation led to me living with my aunt during high school, I saw up close what it meant to stretch every dollar and still fall short of what we needed. By the time I got to college, I knew how to survive—but I hadn’t yet learned how to build.

My purpose revealed itself in pieces. It was in the moment I turned down a childhood field trip because I didn’t want to burden my family with the cost. It was in the decision to work two jobs in college—not just to stay afloat, but to send money home so my younger siblings could play sports and feel like normal kids. It was in the realization that I wasn’t the only one trying to rewrite a financial story built on scarcity, trauma, and self-sacrifice.

I didn’t just want to break the cycle—I wanted to map the path out.

That’s why I founded Finansis LLC, wrote How to Afford Everything, and created Piggy Bank Pathways—a financial literacy program for kids and families. Because people like me, like my students and coaching clients, deserve more than shame-based advice. We deserve financial tools that make space for caregiving, culture, and community. We deserve a system that shows you how to build wealth without turning your back on the people who made you.

My purpose is to turn survival skills into wealth-building strategies—for the working parent, the student with a second job, the person who feels behind, and the child who thinks money is something they’ll never have enough of.

I don’t promise quick fixes. But I do promise clarity, compassion, and action. Because once I figured out how to afford everything that mattered to me—I knew I had to help others do the same.

Thanks for sharing that. So, before we get any further into our conversation, can you tell our readers a bit about yourself and what you’re working on?

I’m Dr. Darla Bishop—author, speaker, and founder of Finansis LLC, where our mission is to make financial wellness accessible at every stage of life. My journey started with navigating financial struggle as a teenager and learning how to fund 14 years of post-secondary education with very little student debt. That lived experience, paired with my public health background, shaped the work I do today: helping families, schools, and professionals build wealth without shame.

What makes our work unique is that it meets people exactly where they are. Whether it’s a parent trying to stretch every dollar, a college student juggling classes and bills, or a child learning what money even is—we offer practical tools that turn everyday moments into financial learning opportunities. I don’t believe in one-size-fits-all advice. Instead, I offer frameworks that help people create stability while honoring their real lives and responsibilities.

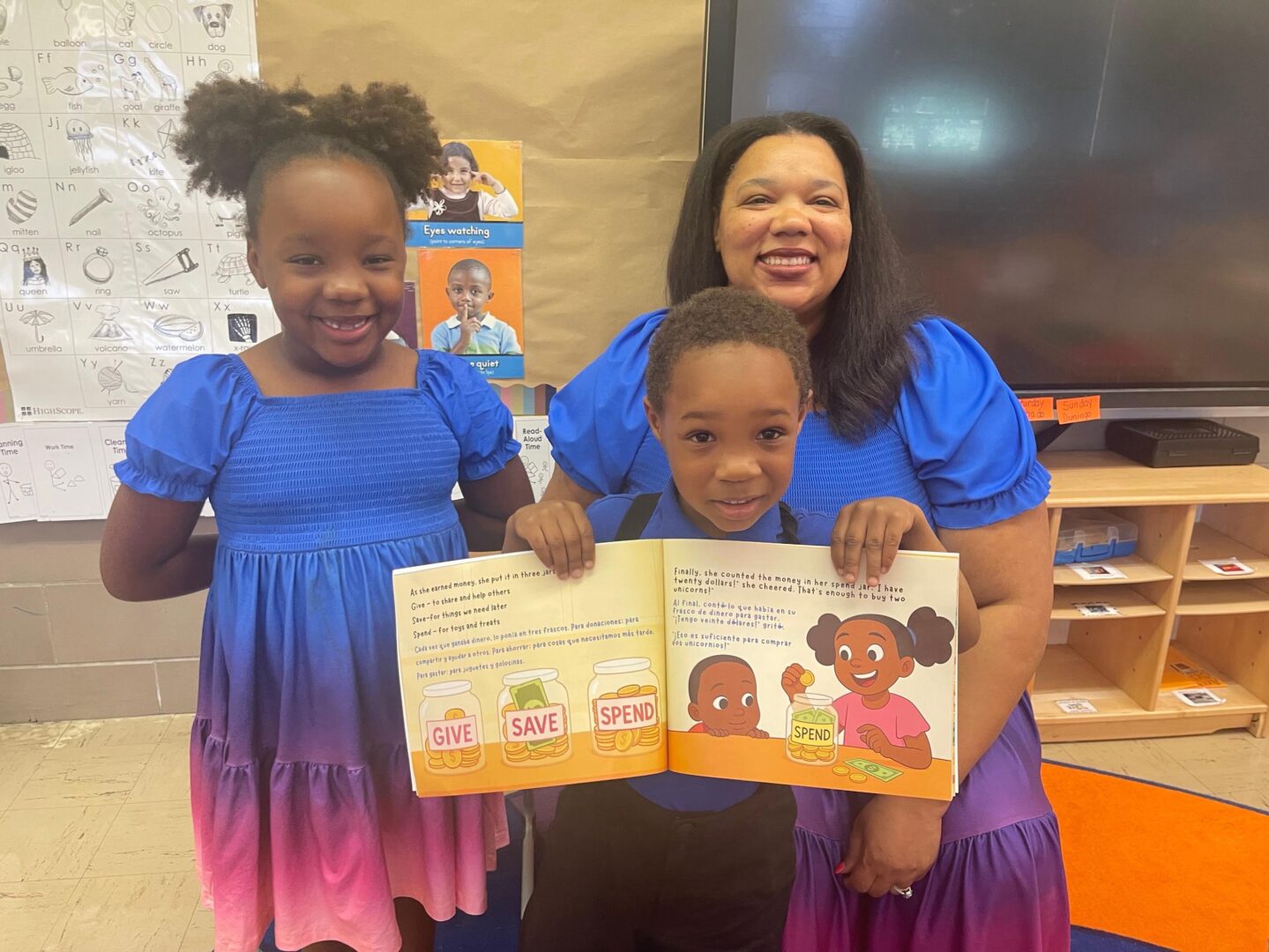

Right now, I’m especially excited about the launch of Piggy Bank Pathways, our early childhood financial literacy curriculum. We’re piloting the program in classrooms this fall, combining storytelling, hands-on activities, and family engagement to teach kids (and their grownups) how to build healthy money habits together.

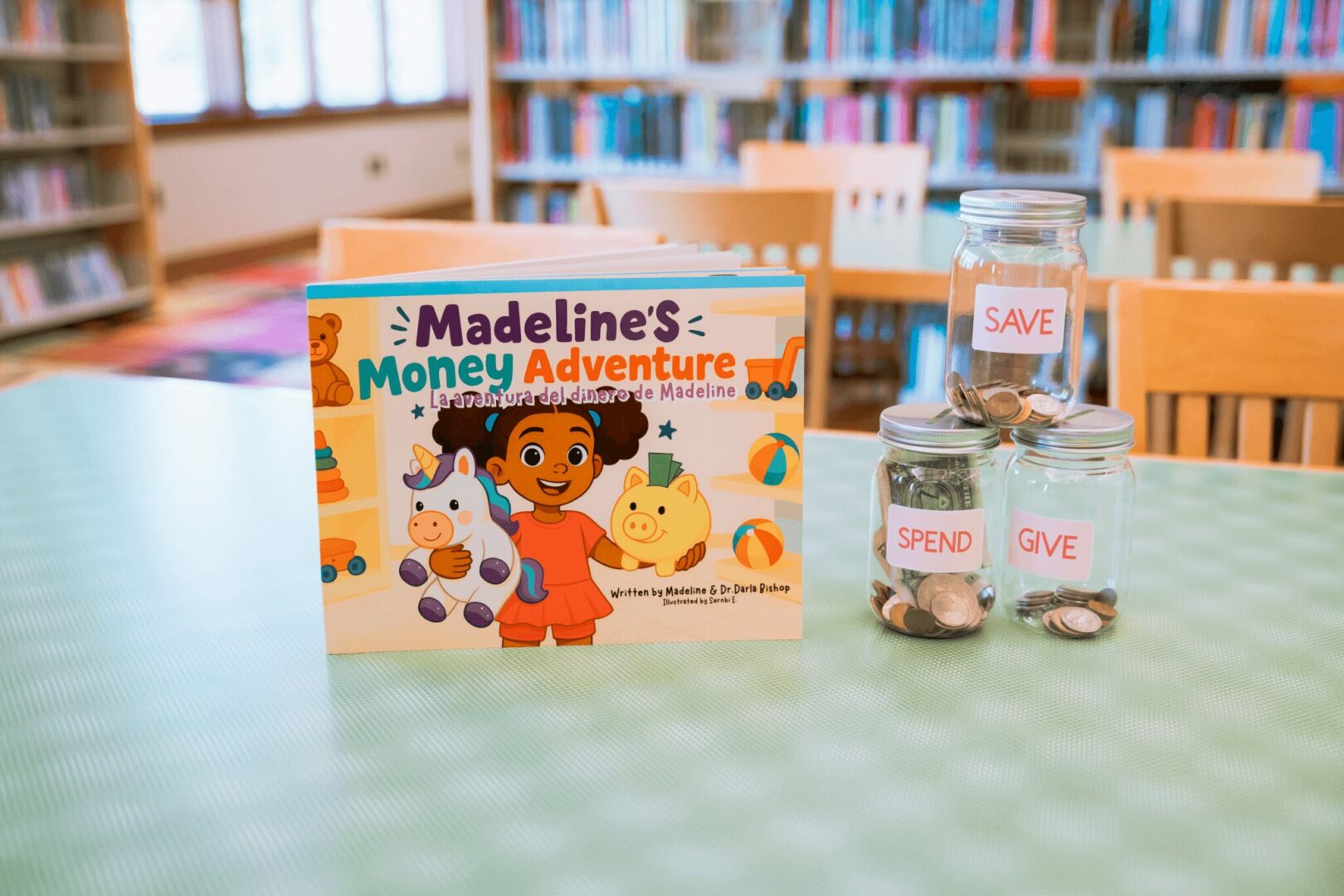

We also just released Madeline’s Money Adventure, a children’s book I co-authored with my 6-year-old daughter to spark joyful, age-appropriate conversations about money at home and in school. Our goal is to reach 10,000 families by year’s end—and we’re inviting schools, credit unions, and community partners to join us.

At the heart of it all is a simple belief: everyone deserves to feel confident with money. I’m building a movement to make that possible.

Looking back, what do you think were the three qualities, skills, or areas of knowledge that were most impactful in your journey? What advice do you have for folks who are early in their journey in terms of how they can best develop or improve on these?

1. Resourcefulness

I didn’t have a financial safety net, so I learned how to build one. Whether it was finding scholarships mid-semester, negotiating tuition support, or budgeting down to the penny, being resourceful was everything. For those just starting out: don’t wait for perfect conditions. Use what you have, ask for what you need, and don’t be afraid to get creative. Resourcefulness turns barriers into possibilities.

2. Emotional Awareness Around Money

Money isn’t just math—it’s emotional. I had to confront financial trauma, scarcity mindsets, and family expectations before I could build lasting stability. If you’re early in your journey, take the time to explore your money memories. What messages did you inherit? What emotions come up when you look at your bank account? The more honest you are, the more powerful your progress will be.

3. Communication Skills

My financial life changed when I learned how to ask—clearly, confidently, and consistently. Whether it was requesting financial aid, negotiating a raise, or asking for support, communication was key. My advice? Practice the hard conversations. Start small if you need to, but speak up. Closed mouths don’t get funded.

Thanks so much for sharing all these insights with us today. Before we go, is there a book that’s played in important role in your development?

The book that’s had the biggest impact on me is Madeline’s Money Adventure—because I didn’t just write it, I co-authored it with my six-year-old daughter.

What started as a simple “yes” when Madeline asked when she would get her own book turned into something much bigger. Collaborating with her not only deepened our bond—it changed the trajectory of my business. It made clear all the ways financial literacy doesn’t have to be intimidating—it can be joyful, creative, and even playful. And when you teach kids early, you don’t just change their future—you start shifting the whole family’s relationship with money.

That realization led to the launch of Piggy Bank Pathways, our early financial literacy curriculum designed for children and the adults who love them. We’re now piloting it in classrooms, equipping educators with tools to teach foundational money skills in a way that sparks conversation and builds confidence at home.

The unexpected lesson? Sometimes your next best idea comes when you slow down and create with someone you love. Madeline’s Money Adventure showed me that kids are ready for these conversations—and that families are hungry for support. It opened up a new lane in my business and a new purpose in my life: changing community health by starting with financial habits at home.

Contact Info:

- Website: https://howtoaffordeverything.com/

- Instagram: https://www.instagram.com/my_finansis/

- Facebook: https://www.facebook.com/howtoaffordeverything/

- Linkedin: https://www.linkedin.com/in/darlabishop/

- Twitter: https://x.com/my_finansis/

- Youtube: https://www.youtube.com/@my_finansis

- Other: https://www.piggybankpathways.org

Image Credits

Paradiso Productions

so if you or someone you know deserves recognition please let us know here.