We caught up with the brilliant and insightful Hannah Kathleen Lopez a few weeks ago and have shared our conversation below.

Hannah Kathleen, we’re thrilled to have you sharing your thoughts and lessons with our community. So, for folks who are at a stage in their life or career where they are trying to be more resilient, can you share where you get your resilience from?

My resilience comes from a deep belief in the power of second chances. In the credit repair industry, I’ve seen firsthand how financial struggles can hold people back, and it’s always been my mission to help them overcome that. Building this business wasn’t easy—there were countless challenges, setbacks, and moments of doubt. But I kept pushing forward because I knew the impact it could have on people’s lives. Every success story, no matter how small, reminded me why I started and fueled my drive to keep going, even when things seemed impossible. My resilience comes from the people I serve and the belief that anyone, no matter their past, can rebuild their financial future.

Thanks, so before we move on maybe you can share a bit more about yourself?

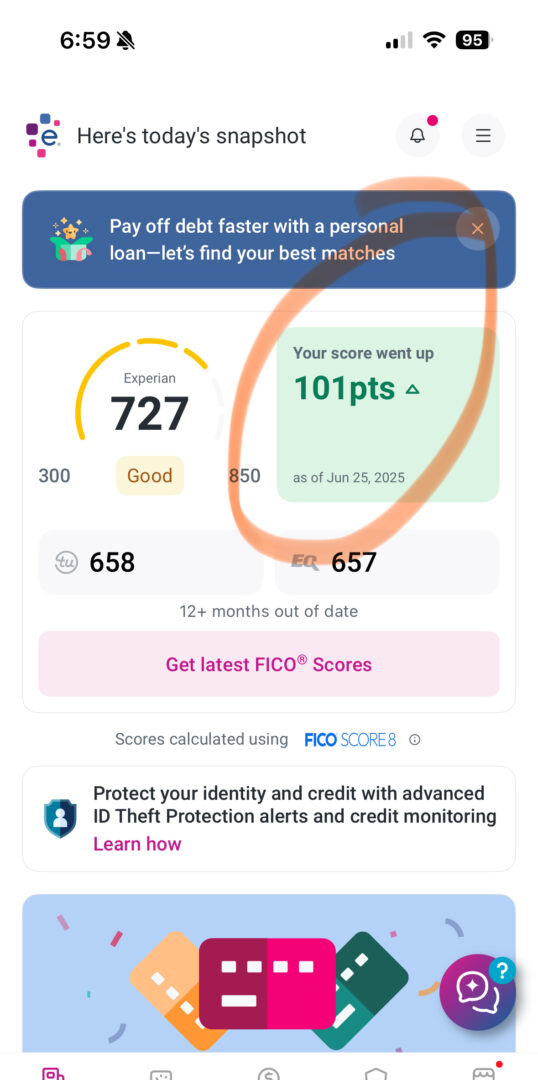

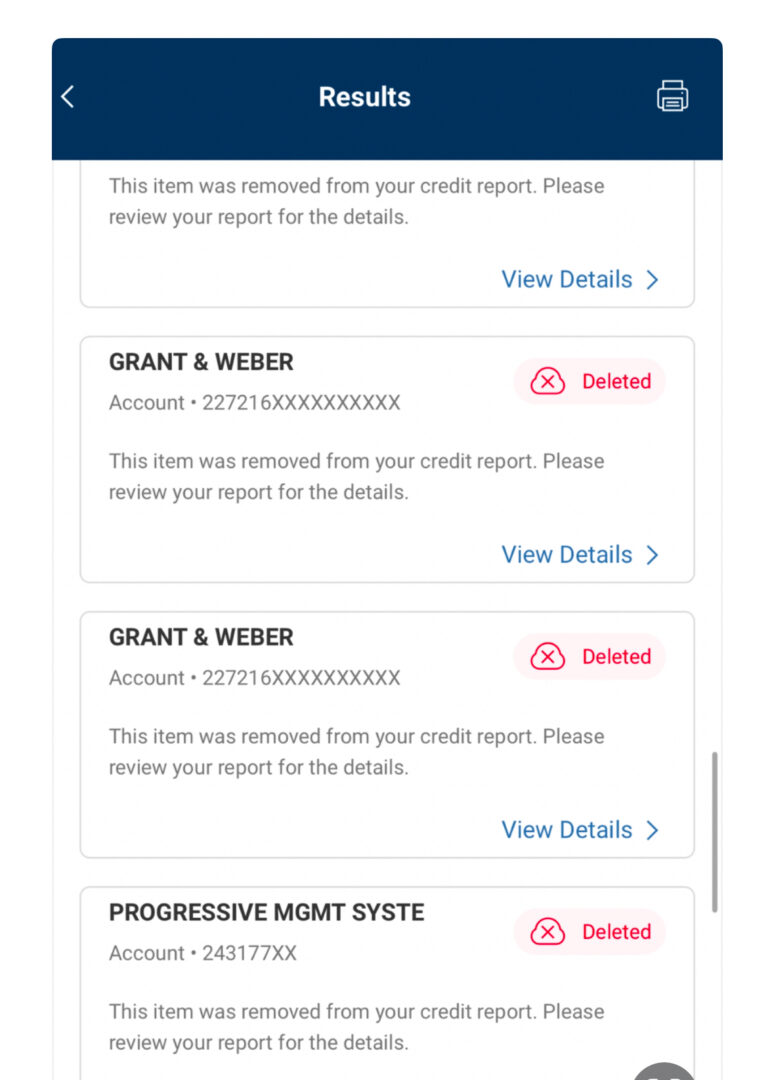

At my core, I help people take control of their financial futures by offering expert credit repair services. I believe everyone deserves the opportunity to rebuild and achieve financial stability, no matter where they’re starting from. What excites me the most about what I do is the transformative power of credit repair. It’s not just about fixing a number on a report—it’s about opening doors to new opportunities, whether it’s buying a home, securing a loan, or simply having the peace of mind that comes with a better financial standing.

What makes my brand special is the genuine care we put into each case. We don’t just view clients as numbers, but as individuals with unique goals and challenges. Every client’s journey is personal, and we tailor our approach to suit their needs. What I’m especially excited about right now is the expansion of our services to include educational workshops and one-on-one financial coaching. We’re not just fixing credit—we’re empowering people with the knowledge to maintain it for the long term. This expansion is something I’ve been working towards for a while, and I can’t wait to see how it helps even more people take control of their financial futures!

Looking back, what do you think were the three qualities, skills, or areas of knowledge that were most impactful in your journey? What advice do you have for folks who are early in their journey in terms of how they can best develop or improve on these?

Looking back, the three qualities that were most impactful on my journey were resilience, financial literacy, and empathy.

Resilience was key because the credit repair industry can be tough. There are moments when it feels like progress is slow, and setbacks seem to pile up. Staying persistent, learning from mistakes, and continuing to push forward despite challenges was a game-changer for me. To develop this, my advice is simple: embrace failure as a lesson, not a setback. Keep going even when it feels hard—growth often happens in those tough moments.

Financial literacy was a huge factor, too. Understanding the ins and outs of credit, debt management, and financial regulations was essential to offering real value to my clients. I recommend diving deep into learning—read books, take courses, or find mentors who can help you understand the financial landscape. The more you know, the better you’ll be at guiding others and making informed decisions for yourself.

Finally, empathy is what has truly set my business apart. It’s easy to overlook how emotional financial struggles can be. Understanding my clients’ unique situations allowed me to provide tailored, compassionate solutions. My advice here is to always listen first, and truly care about the people you’re serving. It will make all the difference in your success and in the relationships you build.

For those starting out, focus on building resilience by staying consistent, get comfortable with financial concepts (and keep learning), and develop empathy by understanding the human side of what you’re doing. This foundation will carry you through the inevitable bumps along the way.

How would you describe your ideal client?

My ideal client is someone who is ready to take control of their financial future and is committed to making positive changes. It’s not just about having bad credit—it’s about having the mindset to repair it and move forward. The ideal client for me is someone who is open to learning and willing to put in the effort, whether it’s understanding their credit report, following through with advice, or staying consistent with the steps required to improve their score.

I particularly connect with people who are frustrated with their current financial situation and are ready to break free from the cycle of debt or poor credit. They’re not looking for a quick fix, but rather a long-term solution. This type of client values education, understands that progress takes time, and appreciates the transparency and support we offer throughout the process.

Ultimately, my ideal client is someone who is dedicated to change and values the empowerment that comes with rebuilding their credit—and is willing to partner with me every step of the way to make that happen.

Contact Info:

- Website: https://www.strategicways.org

- Instagram: Katlopez_1001

Image Credits

Hannah Salazar Lopez

so if you or someone you know deserves recognition please let us know here.