Alright – so today we’ve got the honor of introducing you to Jordan Farr. We think you’ll enjoy our conversation, we’ve shared it below.

Jordan , we’re thrilled to have you on our platform and we think there is so much folks can learn from you and your story. Something that matters deeply to us is living a life and leading a career filled with purpose and so let’s start by chatting about how you found your purpose.

I found my purpose by living through the exact financial struggles I now help others navigate. At one point, I had over $60,000 in consumer debt and felt completely overwhelmed by money. But instead of staying stuck, I began learning everything I could about personal finance—from budgeting to investing to real estate. As I applied those lessons and turned my situation around, something clicked: this knowledge shouldn’t be gatekept.

That’s when Aligned Finances was born. I started sharing my journey, first informally, and then professionally, with a mission to make financial education accessible, judgment-free, and values-aligned—especially for Millennials and Gen Z who were never taught how to manage money in a way that feels empowering. My purpose is to help people feel confident and in control of their money, no matter where they’re starting from.

Let’s take a small detour – maybe you can share a bit about yourself before we dive back into some of the other questions we had for you?

I’m the founder of Aligned Finances, a financial education platform that helps Millennials and Gen Z feel confident and in control of their money. I started the business after paying off over $60,000 of consumer debt and realizing how transformative financial education can be—not just for your bank account, but for your entire life.

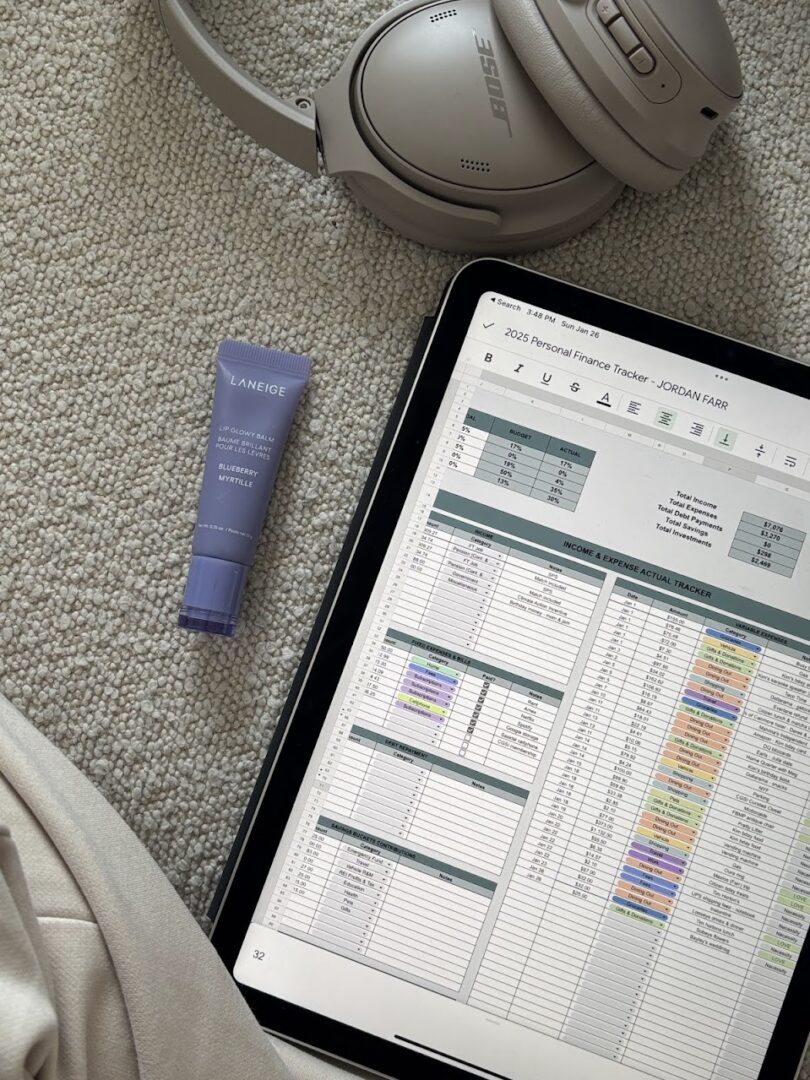

Aligned Finances is built around the idea that money is personal, and your financial plan should reflect your values, not just your numbers. I work with clients through 1:1 coaching, downloadable tools, and educational events to help them budget with clarity, invest with confidence, and build long-term wealth—without shame or overwhelm.

What’s most exciting to me is watching people go from feeling stuck or anxious about money to feeling truly empowered. That transformation is why I do what I do.

Right now, I’m especially focused on building Her Finance Collective—an affordable, supportive community where members can learn about money together through webinars, expert Q&As, challenges, and more. I’m also in the process of building a Financial Wellness 101 course, designed to give folks a solid foundation in budgeting, saving, and investing, no matter where they’re starting from.

Aligned Finances is here to show that financial freedom is possible—and that you don’t have to do it alone.

There is so much advice out there about all the different skills and qualities folks need to develop in order to succeed in today’s highly competitive environment and often it can feel overwhelming. So, if we had to break it down to just the three that matter most, which three skills or qualities would you focus on?

Looking back, three qualities that were most impactful in my journey were:

Resilience – There were moments I felt completely overwhelmed by debt and unsure where to begin. But I kept showing up, even when progress felt slow. Resilience helped me stay committed through the ups and downs, especially early on when the results weren’t immediate.

Financial literacy – Learning how money actually works—budgeting, investing, managing credit, understanding real estate—was a total game-changer. I wasn’t just guessing anymore. I could make informed, empowered choices and build a long-term strategy rooted in my values.

Willingness to do things differently – I didn’t follow the “traditional” path. I invested while still in debt, co-owned properties in creative ways, and built a business around transparency and accessibility. Being open to unconventional choices helped me find solutions that actually aligned with my goals and lifestyle.

My advice for anyone early in their journey:

Start before you feel ready. You don’t need to have it all figured out—just take the first step. Learning builds confidence.

Focus on progress over perfection. Small, consistent actions add up.

Stay curious. Ask questions, challenge norms, and be open to learning. Financial knowledge is a skill set—not a personality trait—and anyone can build it.

How would you describe your ideal client?

My ideal client is someone who’s ready to take control of their finances—even if they’re not sure where to start. They’re often Millennials or Gen Z who care deeply about living a values-aligned life and want to use money as a tool to support their goals, not define their worth.

They might feel overwhelmed, ashamed, or stuck when it comes to money, but they’re also curious, open-minded, and motivated to learn. They’re not looking for a “get rich quick” strategy—they want practical, empowering guidance that meets them where they are.

What makes someone an ideal client isn’t their income or net worth—it’s their willingness to be honest, reflect on what matters most to them, and take meaningful steps toward building a financial life they feel good about.

Whether they’re navigating debt, learning to budget, investing for the first time, or considering real estate, I’m here to support them with education, encouragement, and zero judgment.

Contact Info:

- Website: https://alignedfinances.ca

- Instagram: @alignedfinances

- Linkedin: Aligned Finances

- Youtube: https://www.youtube.com/@alignedfinances

so if you or someone you know deserves recognition please let us know here.