We caught up with the brilliant and insightful Ted McLyman a few weeks ago and have shared our conversation below.

Ted , we’re thrilled to have you on our platform and we think there is so much folks can learn from you and your story. Something that matters deeply to us is living a life and leading a career filled with purpose and so let’s start by chatting about how you found your purpose.

Interview Question: Where did you find your purpose?

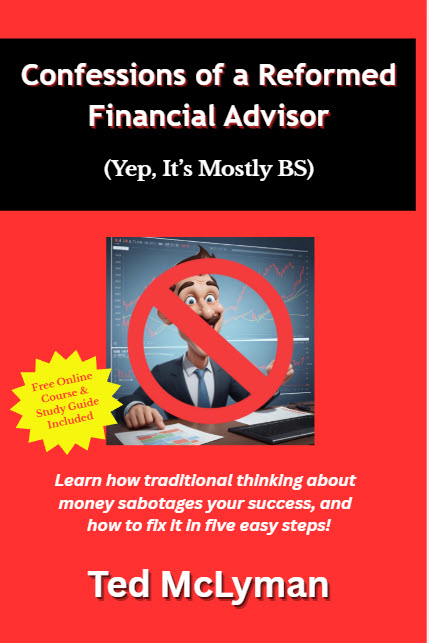

Ted McLyman, Confessions of a Reformed Financial Advisor.

Questions: Have you ever found yourself in a similar situation? I was leading a pretty successful financial planning operation—actually, a great one. In just about eighteen months, I turned around a struggling district and elevated it from the bottom to the top.

My performance was strong overall, except in one area: my team had not introduced the company’s new suite of financial products and services. I decided not to offer these new products because they did not meet the needs of my local market. The minimum income threshold legally required for these products was much higher than what my market could support. Promoting them made little sense.

Usually, we held quarterly reviews with the regional VP over the phone. However, I was told to visit the regional office, about 125 miles away, instead of having our usual phone call for my upcoming review. During the meeting, the regional VP tore into me. According to his data, I had gone from “hero” to “the regional awful example.” He told me I had no choice and assigned me a ridiculous quota for the next quarter. It didn’t surprise me.

Looking back, I can’t help but smile. I should thank the VP for setting me on the path I’m on today. Unknowingly, a thirty-minute meeting cemented in my mind the many flaws of the traditional financial industry and sparked personal and professional change.

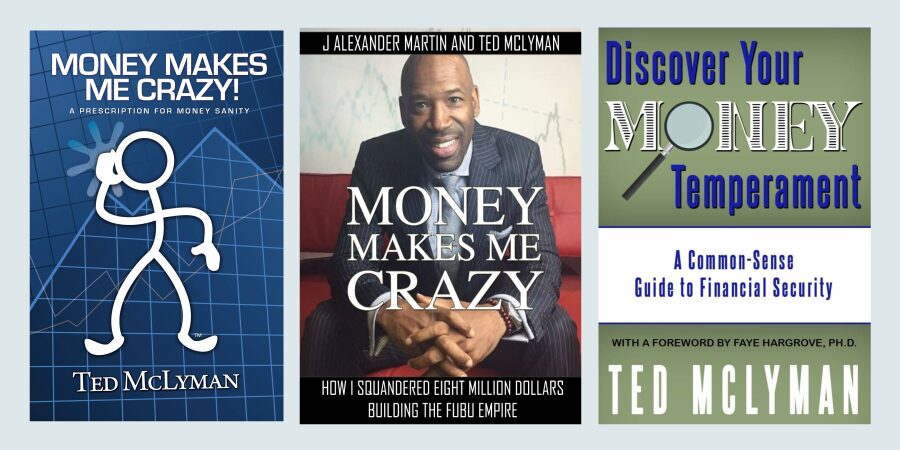

Metaphorically, I immediately realized my ladder was not only leaning against the wrong wall but also the wrong building. Even worse, I was on the wrong ladder altogether. Soon after, I launched Apexx Behavioral Financial Group and published my first book, Money Makes Me Crazy. This ultimately led to the co-founding of DreamSmart Behavioral Solutions and the publication of three additional books on money behavior.

Business as usual with money doesn’t work for most people. Few are naturally skilled at managing their finances. Conventional wisdom is flawed. We are emotional creatures who think, not thinking beings with emotions.

My rallying cry is: “How you behave with money is more important than what you know about money.” I reject the status quo. It’s time for a new money paradigm.

Let’s take a small detour – maybe you can share a bit about yourself before we dive back into some of the other questions we had for you?

I’ve worked with people and money my entire professional life. What I’ve learned is that traditional economics, finance, and literacy thinking does not work for most people in the real world. Our biology, values, beliefs, and culture conspire against us when we choose and spend.

Our brains evolved to keep us alive and seek opportunities. Not to do taxes, read financial statements, and do long-term planning. Our family, peers, and culture shape our values and beliefs about money, influencing our spending. All made faster and easier by technology.

.

Studies show 95% to 99% of all spending is unconscious, automatic, and emotional. Why? Because we are emotional beings who think, not thinking beings with emotions. Ironically, we accept this premise in most everything except money.

I’m passionate about changing conventional wisdom about money. Business as usual is not working for most people. We are not rational spenders. Cookie-cutter financial strategies and plans generally only work for people who are “wired for money.” Most aren’t. They need a different personalized approach that is values-driven and behaviorally based.

My simple common-sense Money Behavior System offers an easy solution. It has five steps: 1) Money Values: what’s important about money to you? 2) Money Temperament: How you naturally behave with money. 3) Money Knowledge: your money learning style and your technical knowledge. 4) Money Strategy: your values-driven behavior-based grand plan for financial peace of mind. 5) Money Plan: your personal “one-size-fits-YOU” plan of action. Traditional financial plans begin at step five.

My new book, “Confessions of a Reformed Financial Planner,” is an easy read for people who don’t read financial books, but should. I talk about my reformation and journey from “financial salesperson” to financial coach. I explain the grand conspiracy that makes spending difficult. And help you use the Money Behavior System to create a personalized financial roadmap for achieving financial peace of mind in your chosen lifestyle.

I am no longer a licensed financial advisor. Today, I help people like you discover their money values, temperament, and learning style. Then craft their path to better money choices and spending.

Along the way, I’m igniting a movement in Behavioral Financial Wellness. It makes money recognized as a subset of your natural behavior. And it’s revolutionary.

Looking back, what do you think were the three qualities, skills, or areas of knowledge that were most impactful in your journey? What advice do you have for folks who are early in their journey in terms of how they can best develop or improve on these?

1) Have an open mind. You can learn something from anyone, regardless of the context or circumstances.

2) Have a sense of humor. Never take yourself too seriously; be self-deprecating, and remain optimistic.

3) Treat everyone with dignity. Believe in humanity.

And for the Marines:

1) Get the job done.

2) Take care of your people.

3) Leaders eat last.

All the wisdom you’ve shared today is sincerely appreciated. Before we go, can you tell us about the main challenge you are currently facing?

My greatest challenge is addressing the conventional wisdom about economics, finance, and financial literacy. Unfortunately, our culture perpetuates the myth of the rational spender..

Contact Info:

- Website: https://tedmclyman.com

- Instagram: https://www.instagram.com/tedmclyman/

- Facebook: https://www.facebook.com/TedMcLyman

- Linkedin: https://www.linkedin.com/in/ted-mclyman/

- Twitter: https://x.com/TedMcLyman

- Youtube: https://www.youtube.com/@TedMcLyman

Image Credits

Ted McLyman.

so if you or someone you know deserves recognition please let us know here.