Alright – so today we’ve got the honor of introducing you to Cumba Dixon. We think you’ll enjoy our conversation, we’ve shared it below.

Hi Cumba, we’re so appreciative of you taking the time to share your nuggets of wisdom with our community. One of the topics we think is most important for folks looking to level up their lives is building up their self-confidence and self-esteem. Can you share how you developed your confidence?

I cannot remember when, but I have always taken the approach that I belong just as much as the next person. I believe that God created us equally despite our differences. Growing up in Monrovia, Liberia, my parents did everything to help me understand that everyone matters. Moving to the U.S. for college, I was reminded that even though I found myself in a different country, people are people. Therefore, I try to carry myself with confidence knowing that I matter and belong in whatever room I walk into. I’ve always taken the approach that I am just as worthy as anyone else in the room. At the end of the day, we all put our pants on the same way, one leg at a time.

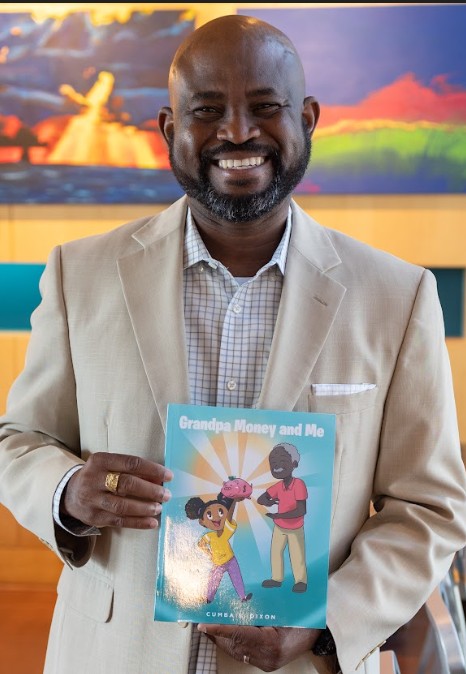

Appreciate the insights and wisdom. Before we dig deeper and ask you about the skills that matter and more, maybe you can tell our readers about yourself?

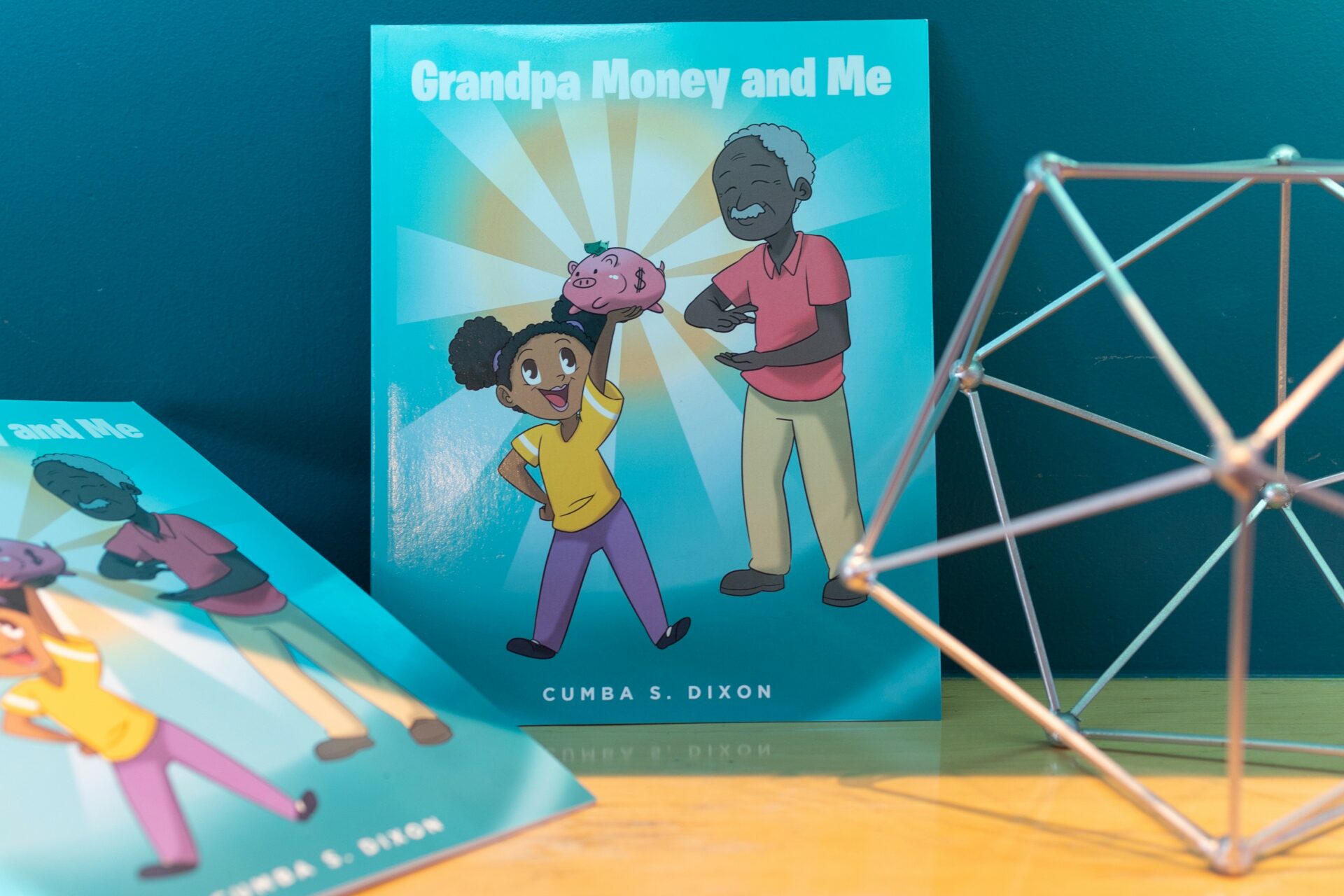

After over 20 years of closing the books each month in an accounting role, I decided it was time to check out of the repetitive cycle and build a business. The foundation of 1322 Legacy Consulting is based on Christian principles beginning with the business’ name. Proverbs 13:22 states in part that “a good person leaves an inheritance for their children’s children….” My goal and aspiration is to create generational wealth that is passed down to my children and grandchildren.

1322 Legacy Consulting, LLC provides financial coaching services to individuals and businesses. We work to educate individuals and families about the foundational principles of finances. We also serve engaged couples and newlyweds as well as married couples that have run into financial difficulties create a strong financial structure for their relationship with the goal of financial unity.

We also work in partnership with entrepreneurs and small businesses to understand the numbers behind the business. This includes knowing the profit and loss, costs and expenses in addition to developing revenue projections and financial strategies.

I am excited to help people understand their finances so that they can do better with what they have and make dreams become reality.

If you had to pick three qualities that are most important to develop, which three would you say matter most?

I have found that positive attitude, being a go-getter, and not being afraid to step out on faith to try something new are essential qualities to have when branching out.

Who is your ideal client or what sort of characteristics would make someone an ideal client for you?

My ideal clients include individuals that would like to create a custom financial plan in order to meet their current life goals as well as their future dreams. Additionally, we love working with couples to create unity at the beginning of a relationship or when there is financial strife when both individuals have differing financial ideas. For our families and kids, we seek to educate and promote age-appropriate financial literacy that will help begin strong foundational principles for adult independence. Another aspect of the business is to work alongside small businesses and entrepreneurs who need a better understanding of their business’ financial standing by understanding their profit and losses, expenses and fine tune their business plan moving forward.

We also provide consulting services on life insurance benefits with living benefits and retirement rollover that help eliminate the risks that come with a fluctuating market.

Contact Info:

Image Credits

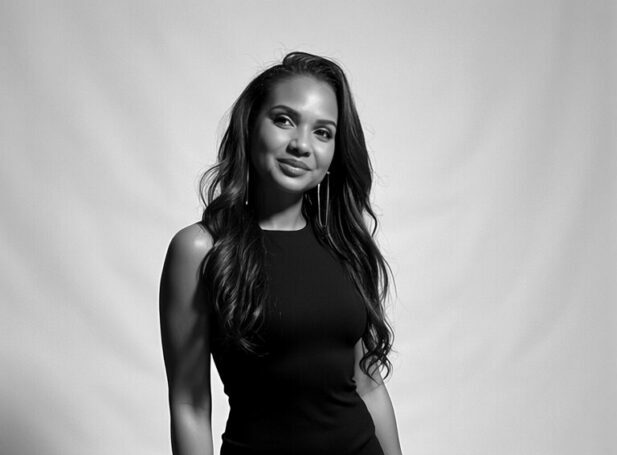

Dewayne Seay